What Are False Breakouts and How to Avoid Them?

Introduction: The Market Loves to Trick You First

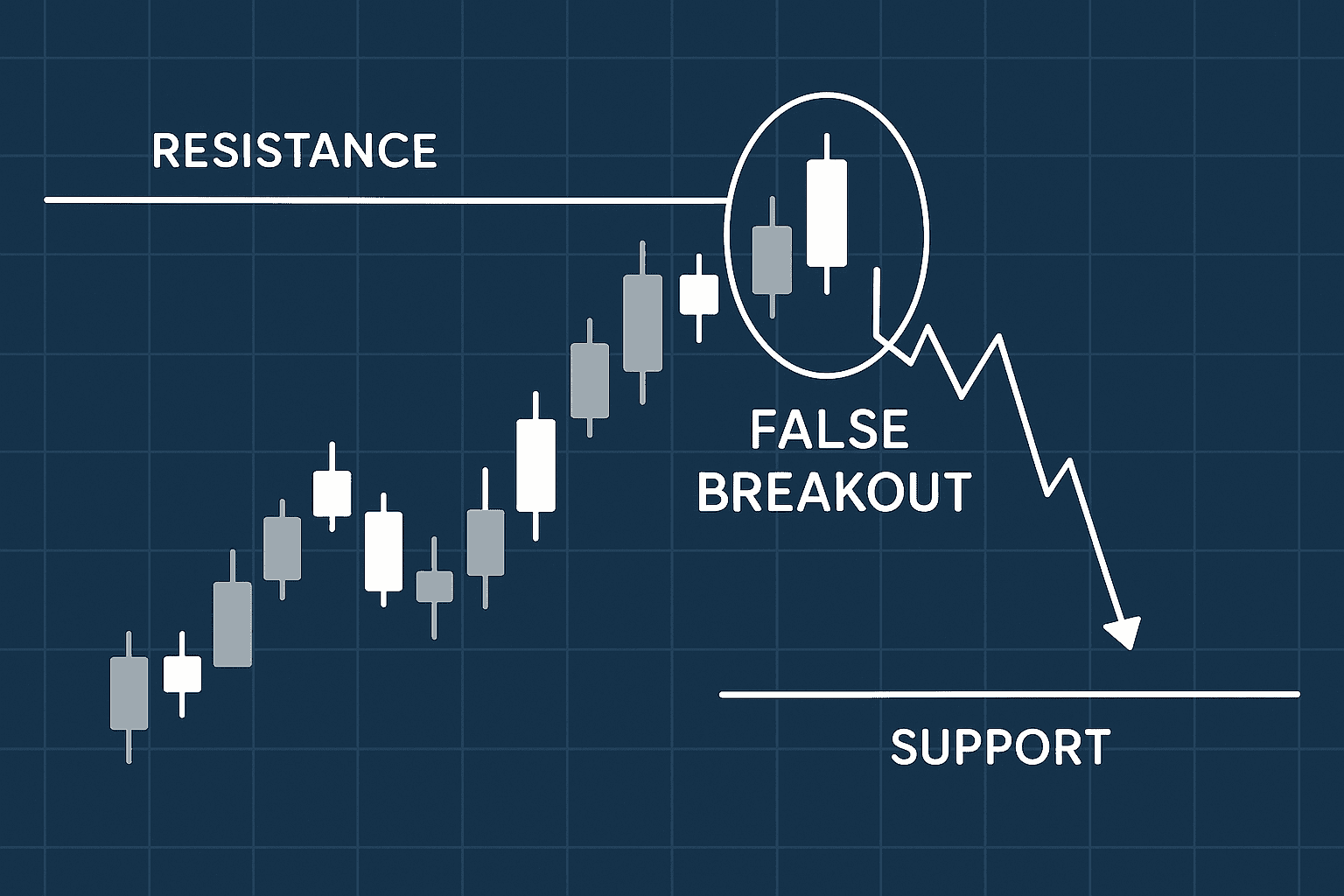

A false breakout happens when price temporarily breaks a key level — only to reverse quickly and trap traders on the wrong side.

If you’ve ever entered a breakout… and got stopped out right before the real move — you’ve seen a fakeout in action.

Let’s explore how to identify these traps and trade with more confidence.

1. What Is a False Breakout?

A false breakout occurs when:

- Price moves beyond support/resistance,

- But fails to hold above/below,

- And quickly snaps back inside the range or pattern.

📉 This is often caused by stop hunts, low liquidity, or news spikes.

2. Why False Breakouts Happen

- Market makers trigger stop losses

- Institutions test the level before entering real positions

- News releases create short-term volatility

- Impatient traders enter too early

⚠️ Gold (XAU/USD) is notorious for fakeouts — especially near round numbers like 1950, 2000.

3. Common Signs of a False Breakout

🔻 Fast rejection candle (pin bar, engulfing)

🔻 Breakout happens on low volume

🔻 Price closes back inside the range quickly

🔻 No follow-through after breakout — price stalls or reverses

🔻 Divergence between price and momentum indicators (e.g., RSI)

4. How to Avoid False Breakouts

✅ Wait for a candle close beyond the level, not just a wick

✅ Look for strong body and momentum

✅ Confirm with volume or breakout of structure

✅ Consider using retests before entry

✅ Use higher timeframes to validate breakout direction

💡 Patience is your best protection.

5. How to Trade False Breakouts Intentionally

Some experienced traders actually trade fakeouts:

- Identify a likely breakout zone

- Wait for a false move above/below

- Enter against the failed breakout

- Place stop outside the false break wick

🎯 This is called “fade the breakout” and works well in ranging or low-volume markets.

Conclusion: Don’t Get Baited by the First Move

False breakouts are common — especially in Forex and gold.

They’re not random — they’re engineered liquidity traps.

Once you recognize them, you stop falling for them… and start capitalizing on them.

🚀 I've been trading for more than two decades, and as you could imagine, in this time, I've tested a lot of brokers. However, there's one brokerage firm that has consistently stood out to me, and I wholeheartedly recommend it to fellow traders and investors - TradeNation.

Trade with my preferred broker, TradeNation! You can open an account HERE.

Find out why I chose this broker HERE!