What Are Major, Minor, and Exotic Currency Pairs?

Introduction: Not All Pairs Are Created Equal

In Forex trading, not all currency pairs behave the same. Some are highly liquid and stable, others are volatile and unpredictable.

To navigate this landscape, you need to understand the three main categories of currency pairs:

- Major pairs

- Minor pairs

- Exotic pairs

Each comes with its own characteristics, opportunities, and risks — and knowing the difference will make you a smarter trader.

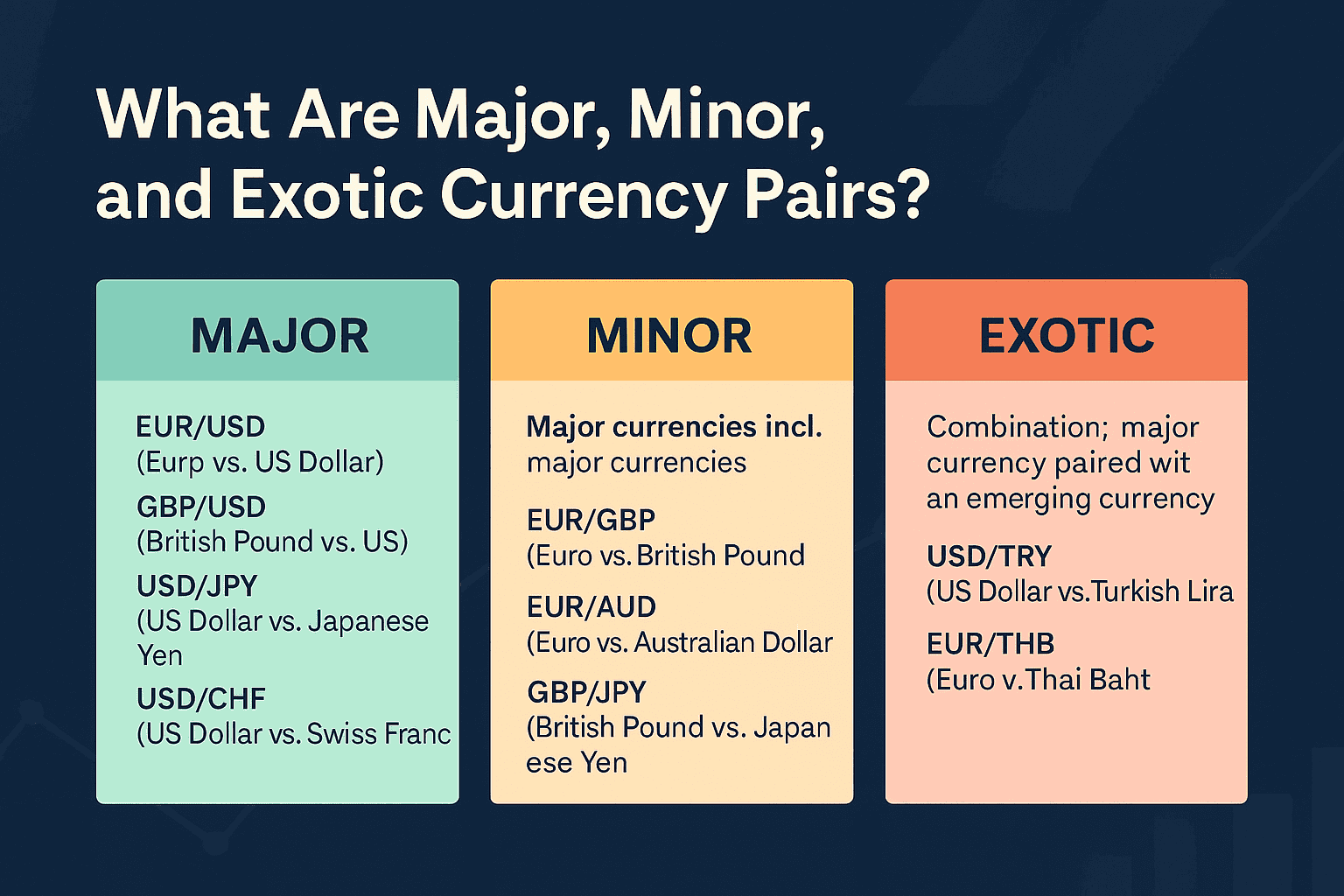

1. What Are Major Currency Pairs?

Major pairs are the most traded and most liquid pairs in the Forex market.

✅ Always include the US Dollar (USD)

✅ Backed by strong economies

✅ Typically have tight spreads and high trading volume

🔹 Examples:

- EUR/USD

- GBP/USD

- USD/JPY

- USD/CHF

- AUD/USD

- USD/CAD

- NZD/USD

💡 These pairs dominate daily Forex volume.

2. What Are Minor Currency Pairs?

Minor pairs (also called cross-currency pairs) do not include USD, but still involve major economies.

✅ Good liquidity

✅ Slightly wider spreads than majors

✅ Popular among experienced traders

🔹 Examples:

- EUR/GBP

- EUR/JPY

- GBP/JPY

- AUD/NZD

- CHF/JPY

🧭 Great for diversification when USD is unstable or ranging.

3. What Are Exotic Currency Pairs?

Exotic pairs combine a major currency with a currency from an emerging or smaller economy.

⚠️ Low liquidity

⚠️ High spreads

⚠️ Susceptible to political and economic shocks

🔹 Examples:

- USD/TRY (US Dollar / Turkish Lira)

- EUR/ZAR (Euro / South African Rand)

- USD/THB (US Dollar / Thai Baht)

- GBP/MXN (Pound / Mexican Peso)

📉 Can be profitable, but riskier — not recommended for beginners.

4. Comparing the Three Types

| Type | Includes USD? | Liquidity | Spreads | Volatility | Best For |

|---|---|---|---|---|---|

| Majors | Always | Very High | Tight | Medium | All traders |

| Minors | No | Moderate | Moderate | Medium–High | Intermediate/advanced |

| Exotics | Sometimes | Low | Wide | High | Experienced traders only |

5. Where Does XAU/USD Fit?

XAU/USD (Gold vs. US Dollar) is not a currency pair, but trades like one.

- High liquidity

- Very volatile

- Behaves similarly to a major pair, but with commodity dynamics

🔍 If you’re trading XAU/USD, treat it as a major-plus-volatility asset.

6. Why This Categorization Matters

Understanding these categories helps you:

- Set realistic expectations (speed, volatility, cost)

- Choose the right strategy and risk management

- Avoid pairs that don’t match your experience level

💡 Don’t trade exotics just because the chart looks tempting. Costs can eat profits.

Conclusion: Match the Pair to Your Skill Level

Knowing whether you’re dealing with a major, minor, or exotic pair gives you an edge.

- Start with majors → easier to manage, lots of educational content

- Explore minors once you’re confident

- Trade exotics only if you understand the risks

🚀 I've been trading for more than two decades, and as you could imagine, in this time, I've tested a lot of brokers. However, there's one brokerage firm that has consistently stood out to me, and I wholeheartedly recommend it to fellow traders and investors - TradeNation.

Trade with my preferred broker, TradeNation! You can open an account HERE.

Find out why I chose this broker HERE!