How to Identify Trends in Forex and Gold?

Introduction: Don’t Trade Without Knowing the Trend

One of the biggest mistakes traders make is jumping into trades without knowing the trend.

If you learn to identify trends correctly, you’ll instantly improve:

- Your entry timing

- Your risk management

- Your ability to hold trades longer

This guide shows how to recognize trends — and when to trust them.

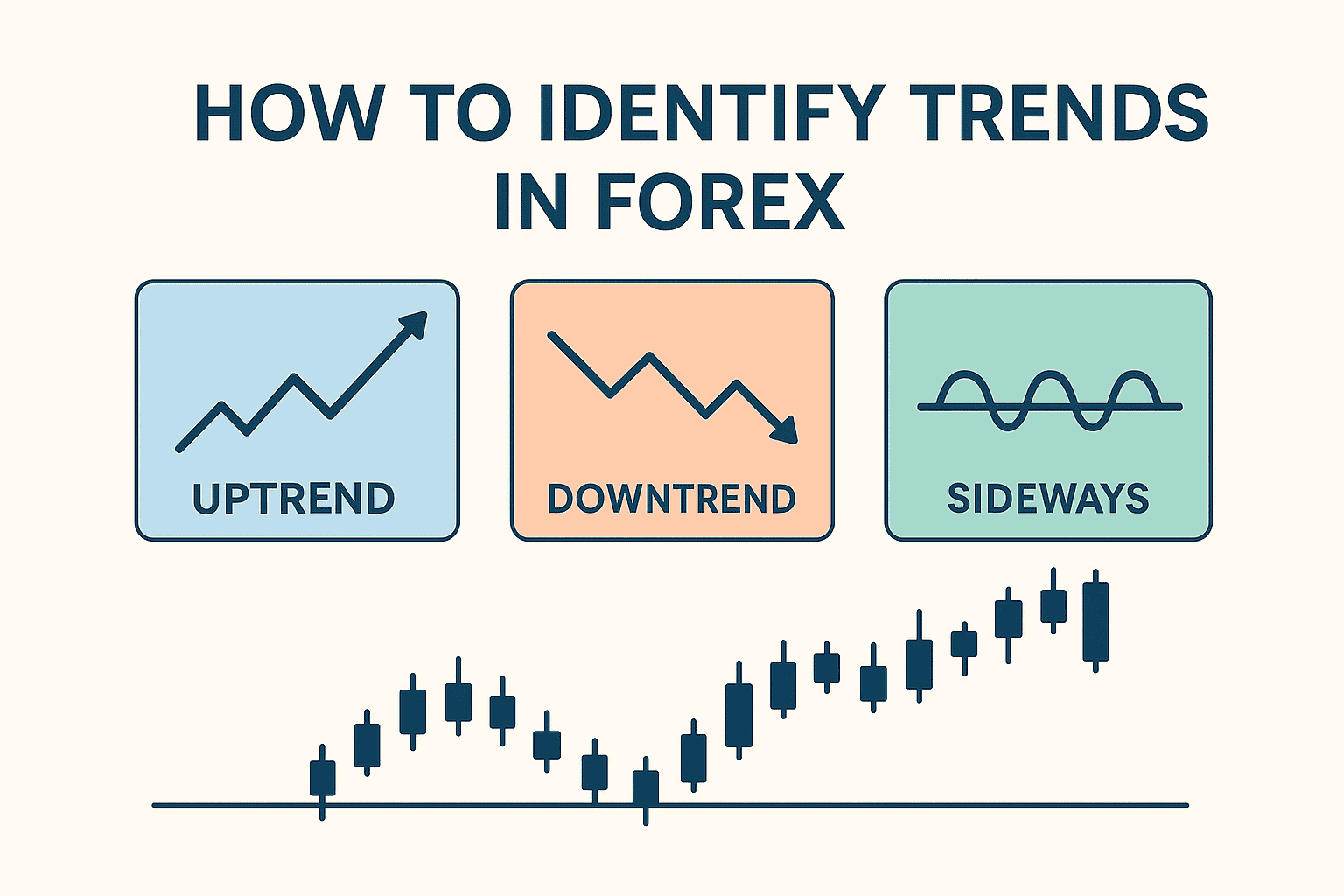

1. What Is a Trend in Forex?

- Uptrend = higher highs and higher lows

- Downtrend = lower highs and lower lows

- Sideways (range) = no clear direction; choppy price

📊 You can spot trends on any timeframe — but higher timeframes (H4, D1) give more reliable context.

2. Price Structure: The Core of Trend Detection

Forget indicators for a second — just look at the chart.

🧱 Uptrend checklist:

- Are highs getting higher?

- Are lows getting higher?

- Are pullbacks shallow?

📉 Downtrend checklist:

- Are highs getting lower?

- Are lows getting lower?

- Is price rejecting resistance?

👀 If structure breaks, the trend may be weakening or reversing.

3. Use Moving Averages for Confirmation

- Price above 50 or 200 EMA → uptrend

- Price below 50 or 200 EMA → downtrend

- MAs turning flat = possible range or transition

💡 Combine structure + EMA for a strong, clear view.

4. Trendlines and Channels

- Draw lines connecting higher lows in uptrends

- Draw lines connecting lower highs in downtrends

- Use parallel channels to visualize movement zones

🎯 Breaks of trendlines often signal momentum shift.

5. Volume and Momentum Help Confirm Strength

- Strong volume during a breakout = reliable trend

- Weak volume = potential trap or range continuation

- Use RSI or MACD to see if momentum supports the trend

🛑 Never trust a breakout without momentum.

6. Don’t Chase Trends — Align With Them

- Don’t enter blindly because “it looks bullish”

- Wait for pullbacks to support in uptrends

- Sell rallies into resistance in downtrends

🧠 Best trades are not taken at the trend start — but at smart continuation points.

Conclusion: Follow the Flow, Don’t Fight It

The trend is your friend — until it bends.

But most of the time, your job is to trade in alignment, not in opposition.

👉 Observe structure

👉 Confirm with tools

👉 Trust the process

🚀 I've been trading for more than two decades, and as you could imagine, in this time, I've tested a lot of brokers. However, there's one brokerage firm that has consistently stood out to me, and I wholeheartedly recommend it to fellow traders and investors - TradeNation.

Trade with my preferred broker, TradeNation! You can open an account HERE.

Find out why I chose this broker HERE!